Many chief compliance officers of registered investment advisers often, and understandably, worry about their personal liability. On July 1, 2022, Commissioner Hester M. Peirce released a statement that showed she is also concerned about CCO liability and laid out a potential framework for determining when CCO liability would be appropriate.

Commissioner Peirce’s statement came in support of an administrative proceeding against Hamilton Investment Counsel LLC (“HIC”) and its Chief Compliance Officer (“CCO”) and principal, Jeffery Kirkpatrick. The Order alleges that HIC “willfully” violated Section 206(4) of the Investment Advisers Act of 1940 and Rule 206(4)-7 thereunder and that Kirkpatrick “willfully aided and abetted and caused HIC to violate Section 206(4)” when, despite numerous red flags, he failed to prevent HIC’s co-owner and investment adviser representative, Eric Hollifield, from misappropriating over $1.7 million from advisory clients by transferring client assets to his outside business. However, Commissioner Peirce stressed that under ordinary circumstances, a registrant’s ultimate compliance obligation belongs to the firm, not to the CCO.

Endorsing a CCO liability framework proposed by the Compliance Committee of the New York City Bar Association, Commissioner Peirce applies six questions to the facts to determine whether CCO liability would be appropriate in this case:

- Did the CCO not make a good faith effort to fulfill his or her responsibilities?

- Did the CCO’s “wholesale failure” to carry out compliance responsibilities relate to a fundamental or central aspect of a well-run compliance program at the registrant?

- Did the wholesale failure persist over time and/or did the CCO have multiple opportunities to cure the lapse?

- Did the wholesale failure relate to a discrete specified obligation under the securities laws or the compliance program at the registrant?

- Did the SEC issue rules or guidance on point to the substantive area of compliance to which the wholesale failure relates?

- Did an aggravating factor add to the seriousness of the CCO’s conduct?

In her statement, Commissioner Peirce answers all six questions as they relate to Kirkpatrick in the affirmative, noting also that Kirkpatrick is a principal of HIC and therefore in a position to address perceived compliance failures. She therefore concludes that CCO liability is appropriate, stating “the CCO had the opportunity to improve the compliance program, but did not do so despite frequently recurring reminders that the program was not working effectively to cover outside business activities.” However, Commissioner Peirce also warns that despite this case, she hopes to avoid “unjustified liability for CCOs based on the firm’s failings or the failings of others at the firm.”

By providing an objective test, Commissioner Peirce’s endorsement of a CCO liability framework in this case may give comfort to chief compliance officers concerned about their own liability for actual or perceived compliance issues at their firms.

About HighCamp Compliance

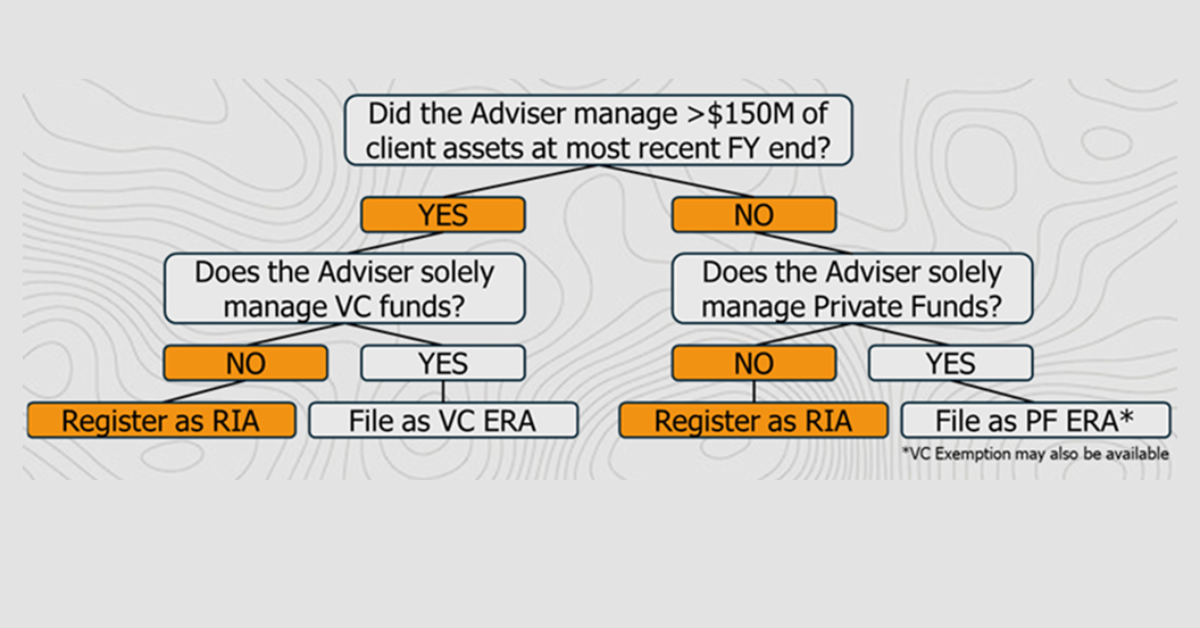

HighCamp is a boutique compliance consulting and outsourcing firm helmed by former SEC examiners, CCOs and proven consulting professionals. HighCamp specializes in regulatory compliance and operational support for SEC-registered private equity, real estate, venture capital, hedge funds and institutional alternative managers. HighCamp is 100-percent employee owned, with a gender-balanced leadership team. The company has locations in New York City (Metro), Los Angeles, Denver, Milwaukee, and Bozeman.