June 24, 2025 – In recent weeks, the SEC has named a new Director of the Division of Investment Management, withdrawn 14 proposed rules, and extended the Form PF compliance date. In addition, the SEC recently submitted its budget request for 2026.

New Director of Division of Investment Management Announced

On June 13, 2025, the SEC announced that Brian Daly will become the new Director of the Division of Investment Management, effective July 8, 2025. Mr. Daly has decades of experience advising fund managers and sponsors on regulatory compliance at law firms and investment management firms.

Proposed Rules Withdrawal

On June 12, 2025, the SEC withdrew 14 proposed rulemakings, several of which would have impacted private fund advisers. Among the withdrawn proposals were:

- Conflicts of Interest Associated with the Use of Predictive Data Analytics (Proposed on July 26, 2023)

- Safeguarding Advisory Client Assets (Proposed on February 15, 2023)

- Cybersecurity Risk Management (Proposed on February 9, 2022)

- Enhanced Disclosures About ESG (Proposed on May 25, 2022)

- Outsourcing by Investment Advisers (Proposed on October 26, 2022)

Form PF Compliance Date Extended

On June 11, 2025, the SEC extended the compliance date for the amended Form PF to October 1, 2025. SEC Chairman Paul Atkins stated that he had directed the SEC staff to review Form PF to determine whether the “government’s use of this data justifies the burdens,” and acknowledged the costs imposed on advisers to complete it accurately. SEC Commissioner Caroline Crenshaw stated that the new Form PF would improve data quality, making it more effective for addressing systemic risk. Crenshaw further added that reconsidering the new Form PF by extending the compliance date ignores prior Commission decisions, bypasses proper rulemaking, and coincides with efforts to open markets to retail investors while limiting access to critical risk data.

AML and Reg S-P Remain In Effect

FinCEN’s finalized AML/CFT rule remains in effect, requiring certain advisers to implement AML/CFT programs, file reports, maintain recordkeeping, and comply with BSA obligations, with a compliance date of January 1, 2026.

The SEC’s finalized Reg S-P amendment remains in effect, requiring covered institutions to implement incident response programs and notify affected individuals within 30 days after becoming aware of unauthorized access. The compliance date is December 3, 2025, for advisers with at least $1.5B in AUM, and June 3, 2026, for advisers with less than $1.5B in AUM.

SEC Budget Request for FY 26

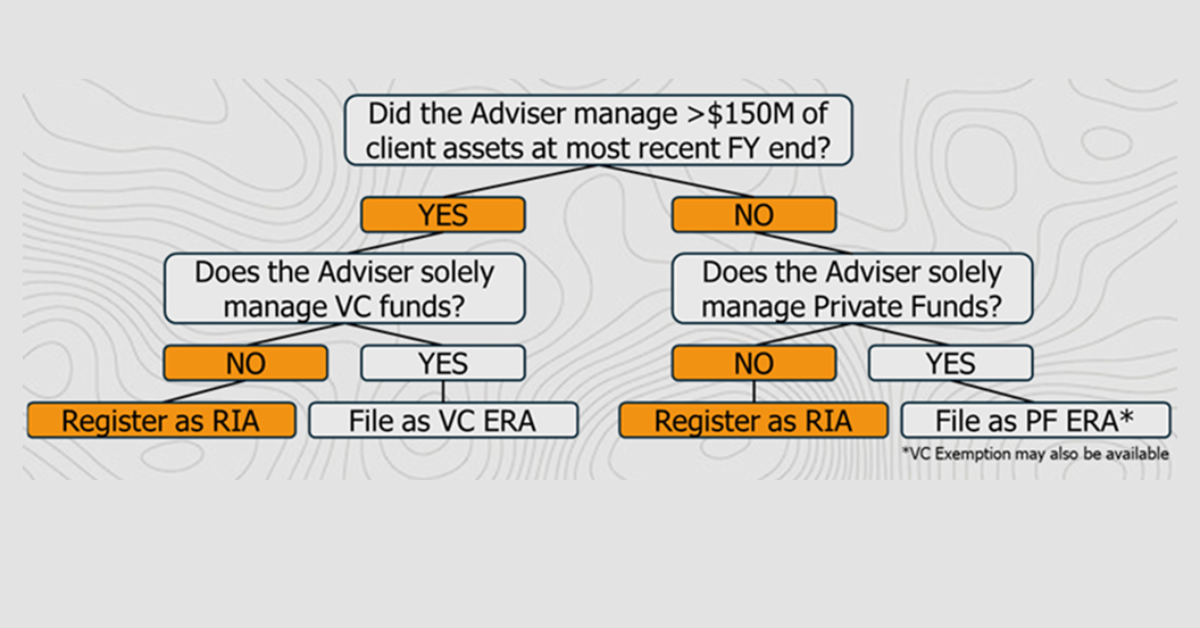

On May 30, 2025, the SEC requested a flat budget of $2.15 billion for fiscal year 2026 in support of 4,101 full-time equivalents. In the request, the letter stated private funds have “experienced dramatic growth over the past decade, nearly tripling their population from approximately 35,000 to over 100,000 funds.”

About HighCamp Compliance

HighCamp is a boutique compliance consulting and outsourcing firm helmed by former SEC examiners, CCOs and proven consulting professionals. The firm specializes in regulatory compliance and operational support for SEC-registered private equity, real estate, venture capital, hedge fund, and institutional alternative managers. HighCamp is 100-percent employee owned, with a gender-balanced leadership team. The company has locations in New York City (Metro), Los Angeles, Denver, Dallas, and Bozeman.